It’s generally accepted and widely applied that paying no more than 30% of one’s gross monthly income for housing is considered an affordable housing situation. According to a report by the Joint Center for Housing Studies at Harvard University, this standard can be traced to its origins back to the 1800s from an adage that stated one should devote “a week’s wage to a month’s rent.” While we know times have most certainly changed, this principle still holds to this day. On the contrary, paying anything above 30% of your gross income for housing expenses is considered “rent or cost burdened.”

News

April 30, 2021

Community Voices: How to calculate your housing expense

Recent Posts

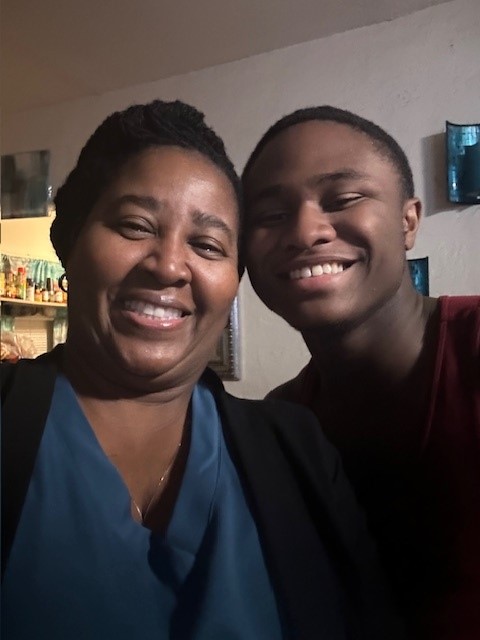

Homeowner Bio: The Wheeler Family

“Always remember that your present situation is not your final destination.” For Lateeria Wheeler, becoming a...

Read More

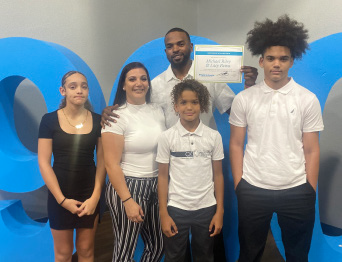

Homeowner Bio: The Rosario Family

“I am building because I want to provide security for my daughters. A home they can...

Read More

Homeowner Bio: The Riley-Paiva Family

“After many issues and frustrations with our living situation, getting accepted into Habitat was like a...

Read More